UK investors have been piling into Hargreaves Lansdown (LSE: HL) shares recently. Last week, the FTSE 100 stock was the fourth most bought share on the Hargreaves Lansdown platform. Investors appear to be betting that the Pfizer vaccine will send the UK stock market, and Hargreaves’ profits, higher.

Is investing in Hargreaves Lansdown shares a smart move for me today? Let’s take a look at the investment case.

Hargreaves Lansdown: coronavirus resilience

While other FTSE 100 companies have struggled this year, Hargreaves has performed well. For example, in August, the company posted a 15% increase in revenue and a 24% increase in profit before tax for the 12 months ended 30 June.

More recently, in October, the group said revenue for the three months to the end of September was up 12% on the same period last year. There are not many companies in the FTSE 100 delivering performances like this at the moment.

Strong financials

Taking a closer look at Hargreaves Lansdown’s financials, there’s a lot to like. Starting with profitability, this is very high. Over the last three years, return on capital employed (ROCE) has averaged 68%. This means that Hargreaves makes a big return on every pound invested in the business.

Moving on to the balance sheet, this also looks excellent. The FTSE 100 company has minimal debt, which means it’s likely to be less vulnerable during challenging periods.

Hargreaves also has a strong dividend track record. Over the last 10 years, the company has lifted its payout from 11.9p to 37.5p per share. Meanwhile, it’s paid a special dividend in four out of the last five years. While most FTSE 100 companies suspended or cancelled their dividends this year, Hargreaves raised its payout by 11% and paid out a huge special dividend. That says something about the quality of the company.

Competitive advantages

What about competitive advantages? Does Hargreaves Lansdown have an edge over the competition?

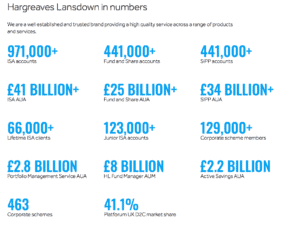

In my view, the company has several competitive advantages. Firstly, there’s its size and market share. At 30 September, it had assets under administration (AUA) of £107bn. That makes it more than twice as big as rival AJ Bell, which had AUA of £49.7bn. Its market share of the UK execution-only market is about 40%.

Source: Hargreaves Lansdown

Secondly, there’s Hargreaves’ platform itself. I think it’s brilliant. It’s very easy to use and the range of investment options is phenomenal. Customer service is also fantastic.

Finally, the nature of the business provides a competitive advantage. Once set up on Hargreaves, it isn’t easy to switch to another provider.

Valuation and yield

Turning to the valuation, Hargreaves shares currently trade on a forward-looking P/E ratio of about 30 and sport a prospective yield of 2.6%. This means the stock isn’t a bargain. However, the share price is currently about 33% below its 2019 high, which suggests there’s upside potential.

I’d buy Hargreaves Lansdown shares

Weighing everything up, I see a lot of appeal in Hargreaves Lansdown shares right now.

The stock isn’t without risk, of course. Competition from the likes of Vanguard is one that comes to mind. The lofty valuation is another.

However, overall, I see HL as a high-quality stock with the potential to rise higher in the long run. I’d buy this FTSE 100 share today.